What is an 'Own Stay Home'?

This is the dream home where you envision residing, creating your haven, and discovering solace amidst the demands of work. As houses become increasingly smaller in Singapore, your search will likely focus on spacious properties that offer convenient access to desired amenities and an ideal location. If it fulfills all the necessary criteria, the age of the development can be disregarded, and you may even find it acceptable to pay a premium. Given its status as your dream home, it's understandable to allocate funds for renovations and high-quality furniture, considering the substantial investment you've already made—the most significant purchase in your lifetime thus far. An "Own Stay Home" is infused with emotions, an entirely natural sentiment.

Given my daily interactions with home buyers, I consistently encounter a recurring sentiment:

It's completely alright to have a different perspective on whether your home should generate financial returns. Ultimately, it's your money and your decision to make. In my role, I aim to offer an additional viewpoint for your research process. Here's some food for thought:

Foor For Thought #1: Who Do You Want To Pay For Your Cost?

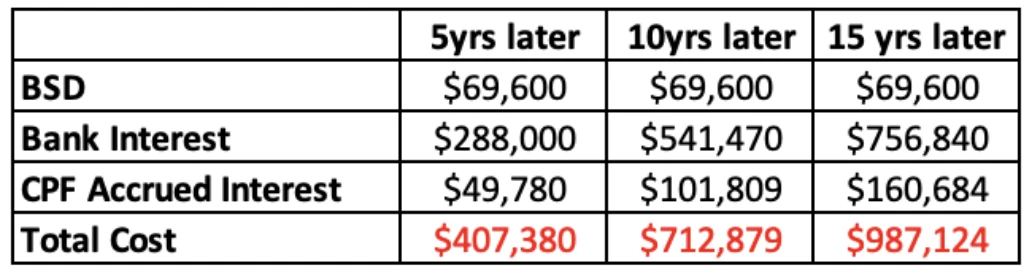

When you purchase a property, there are certain unavoidable costs such as Buyer Stamp Duty (BSD), Mortgage Interest, and CPF accrued interest. The latter is the interest that should have been earned on the funds remaining in your CPF Ordinary Account (OA) if it weren't utilized for mortgage servicing.

BSD, mortgage interest (at a rate of 4%), and CPF accrued interest (at a rate of 2.5%) are the three essential costs incurred during a property purchase. Once these costs are paid, they cannot be recovered.

By purchasing a property we will already be losing BSD + 6.5% cost upfront at 3 point.

To illustrate, let's assume a couple jointly purchases a 3 Bedroom condo worth $2,000,000, under the following conditions:

- Mortgage interest rate: 4%

- Utilization of $350,000 from CPF upfront

- Monthly mortgage payments made using the maximum CPF OA allowable amount.

The total irrecoverable cost can escalate significantly, reaching amounts as high as shown above.

*It's important to note that the figures for bank interest can vary, either increasing or decreasing, based on prevailing interest rates. On better days when interest rate is lower, overall cost will also decrease by a little.

Let's consider a scenario where, five years later, you are able to sell your property at the same price you purchased it for. At first glance, it may appear to be a breakeven situation. However, it's crucial to take into account the sunk costs involved, BSD + Bank Interest + CPF Accrued Interst, such as the $407,380 shown in the above example...

Consideration: Are you comfortable absorbing these costs as the expense of residing in the property for five years? Or, would you prefer a property with profitabllity potential, so your future buyer can to cover these expenses on your behalf?

Food For Thought #2: Might As Welll Just Profit From It

Another perspective to consider is since purchaisng a home is a necessity in Singapore (unless you plan to rent for life paying for other people's mortgages), that makes it a comsuplosry investment, the same amount of cost is going to be put in regardless, then might as well just profit from it at the same time. Time will pass, whether it's five years or ten, and between the choice of making a profit or not, it may be more beneficial to capitalize on the opportunity. Time is also money right?

That being said, there are certain compromises to be made, and this is where the distinction between emotional and rational decision-making comes into play. Of course, I don't encourage a family of four to endure living in a two-bedroom unit, even if the property's value appreciates significantly within a few years. That would be challenging.

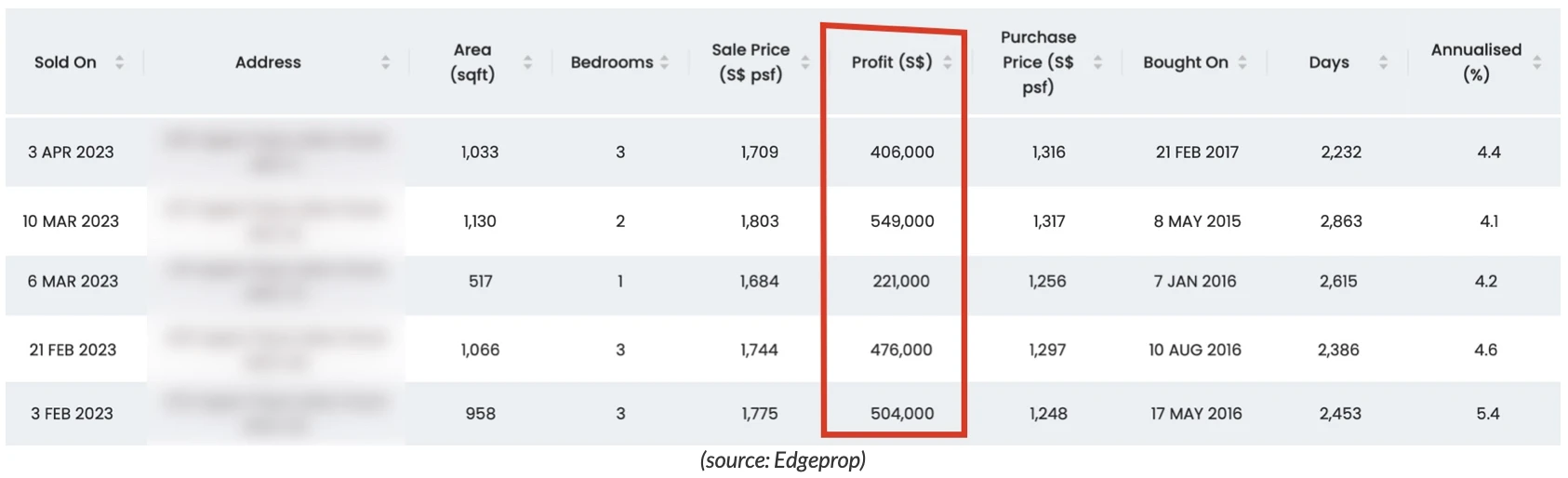

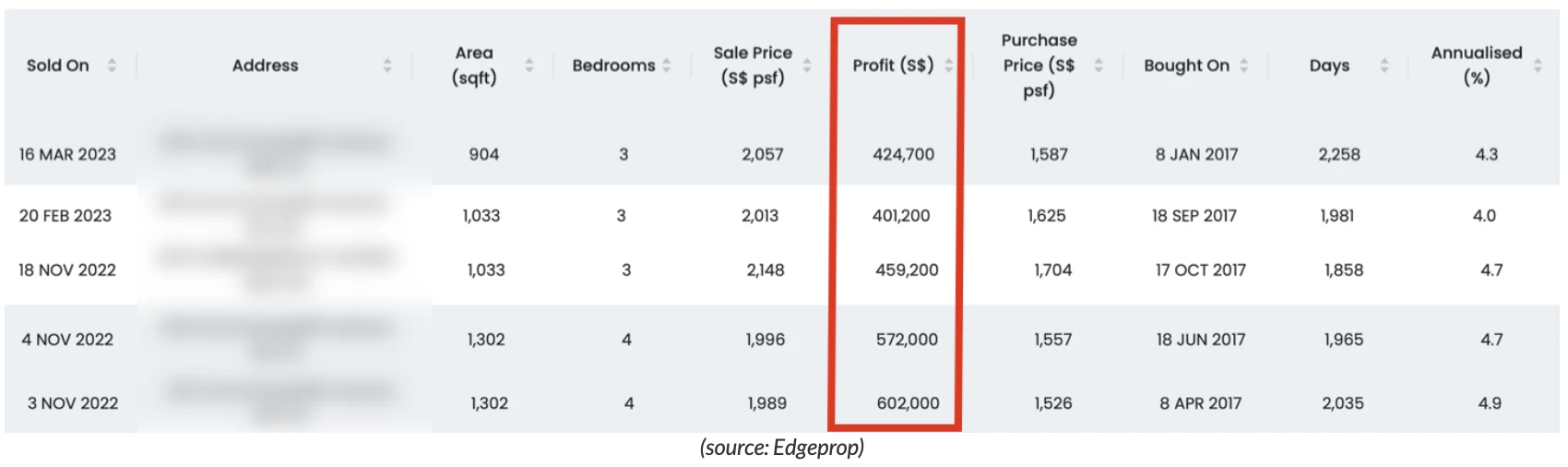

However, is it possible to find a comfortable home that can also yield profits for a viable exit in the future? The answer is YES.

In the above example, owners of 3 bedroom in a developments achieved a profit of approximately $500,000 within five to six years. With such profits, here's what occurred:

- BSD - paid for using the profits obtained from future buyers.

- Bank Interest - paid for using the profits obtained from future buyers.

- CPF Accrued Interest - no problem when not paid by government because it was paid for using the profits obtained from future buyers.

Consideration: Since purchase a home it is a compulsory investment in life, would you reject the opportunity to make a profit? Or would it be better to take advantage of it anyway?

An important disclaimer to note is that such profits are not guaranteed for all developments in Singapore. Choosing the right property significantly increases the likelihood of achieving such results and positions you in a positive outcome. With a good understanding of the developments and the assistance of my 47 criteria for assessing good projects, it is certainly possible. Additionally, timing the market cycle plays a crucial role in maximizing profitability.

Is Making Profit Really That Important?

Throughout my career, I have encountered sellers falling into three categories:

- Those who made a profit

- Those who broke even

- Those who incurred losses

Undoubtedly, the most effortless and gratifying experience, both for me as an agent and for the sellers themselves, is when they have profited. This not only provides them with flexibility and choices for their next property but also allows them to comfortably exit their current one.

On the other hand, sellers who breakeven or made a loss, tried to achieve a desired profit after residing in their homes for a few years often find themselves disappointed. They discover that the property's value has not appreciated significantly over time, and in some cases, it may have even decreased due to certain characteristics of the development. Without substantial profits from the sale, upgrading to a better home becomes challenging. Some eventually make the difficult decision to sell and cash out whatever they can, while others continue to reside in their homes, missing out on opportunities to enhance their living situation or adapt to changing life circumstances. Those who face losses must grapple with the choice of selling at the highest possible value to minimize their losses or remaining in their property indefinitely.

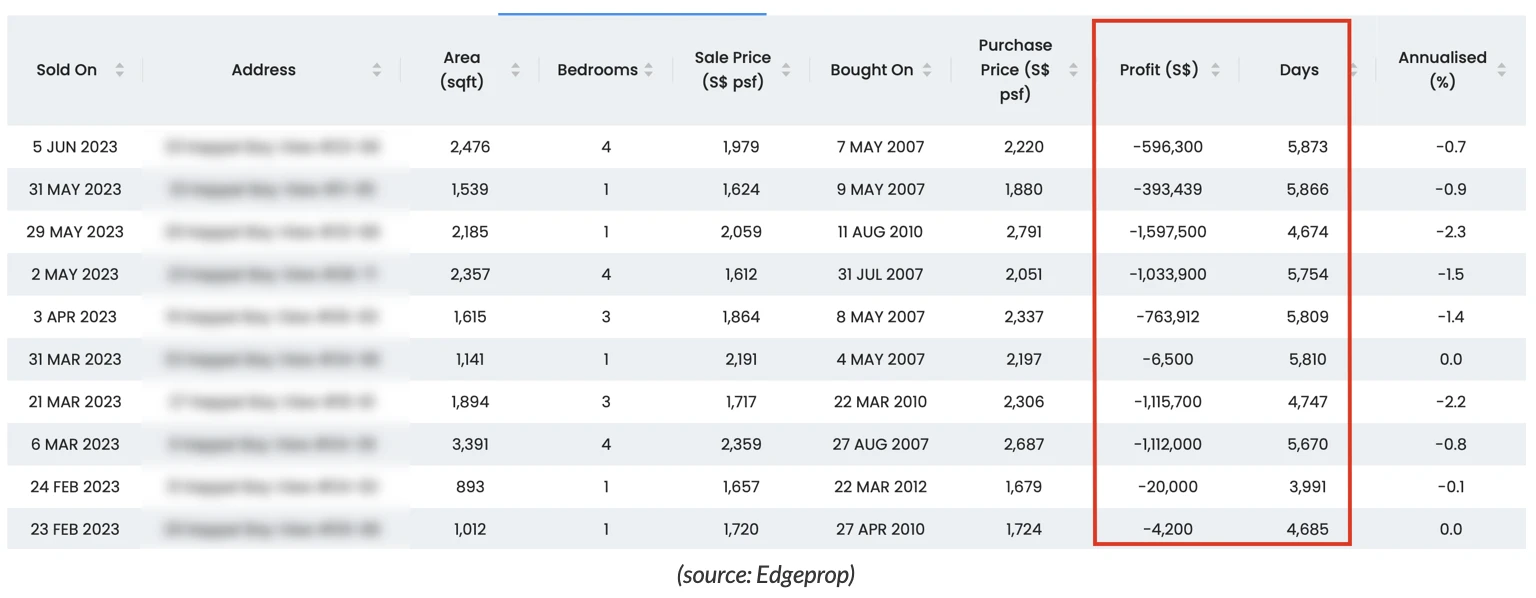

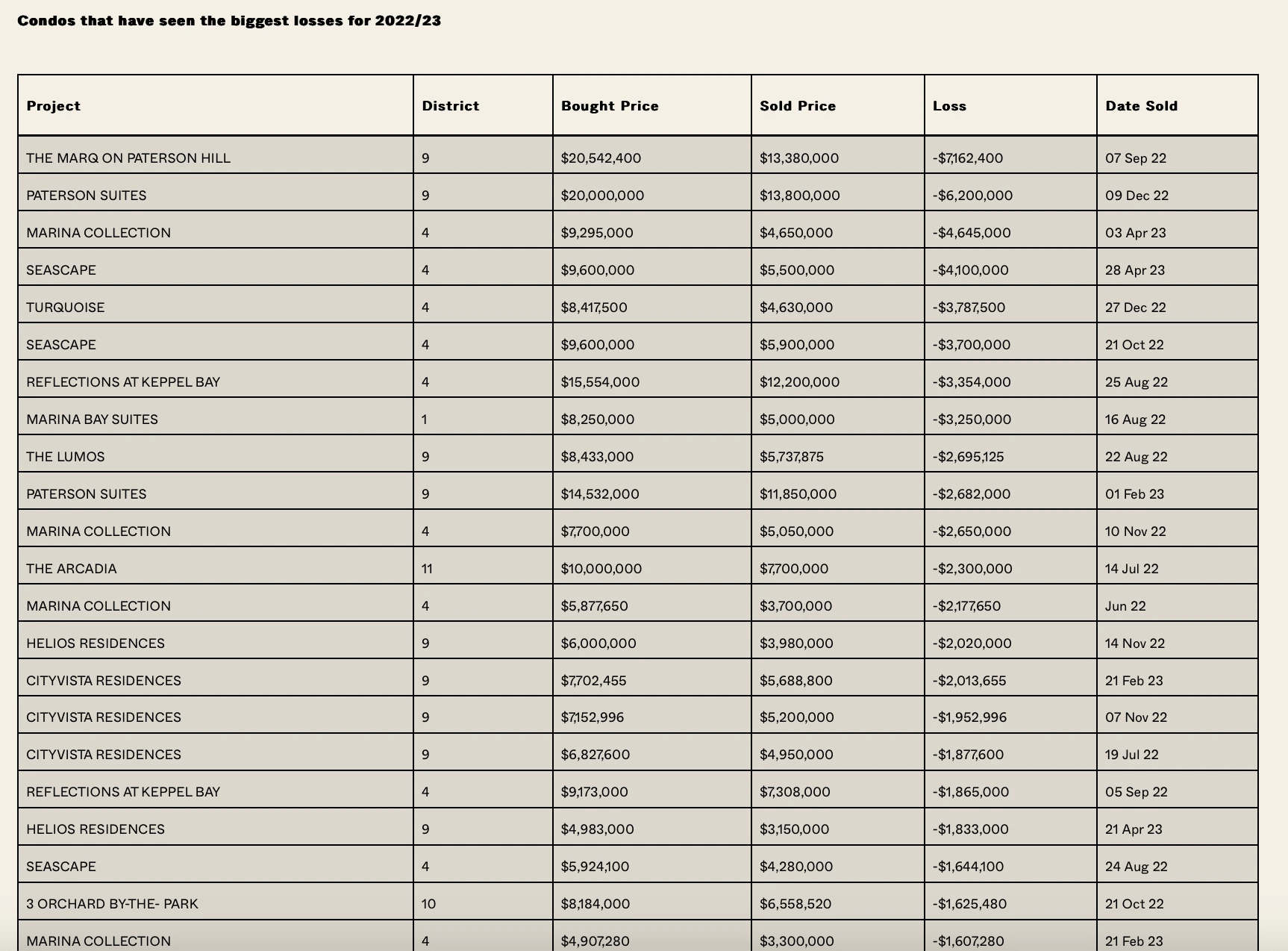

Consider the example above, where the development was an ideal home boasting waterfront living, a generous size, proximity to amenities, and a train station. Despite holding onto the property for 13 years on this dream home, during which the overall market experienced an upward shift, these so-called perfect homes still incurred losses.

Similar to many other homeowners, these individuals initially purchased the property with the intention of it being their 'own stay home'. Undoubtedly, they enjoyed living in their dream home for an extended period. Logically, when faced with a loss, one might opt to hold onto the property rather than sell. At least, that's what I would have done myself. However, even considering the exceptional qualities that attracted them to the property initially which they never thought that they would want to sell it, why do they ultimately choose to sell it, even at a loss of $1,000,000? To be honest, I do not know.

What I do know is that circumstances change, such as:

- The need for a larger space due to a growing family

- The desire to move closer to parents or a specific school

- Financial difficulties necessitating a sale

- Increased earning power over time, prompting an upgrade to a bigger or better home

- Migrating overseas

- Downsizing to a smaller home during retirement

- Escaping an unbearable neighbor

- Not enjoying the home as much as expected

- Frequent maintenance issues due to aging development

- Infestation of termites

- And the list goes on...

(source: Stackedhomes)

Why sell at even at such loss? We do not know but they have their reason for sure.

In Essence:

Profiting from home is always a choice. But again, if given a choice who doesn't want to profit right?

As an agent, it is my responsibility to ensure that my friends and clients make rational decisions rather than solely acting on emotions. Profiting from a property offers them OPTIONS to comfortably exit at any time due to unforeseen circumstances, without a bad taste in the mouth.

After all having options in life is a luxury, don't you prefer that as well?

If you are a first-time buyer or an upgrader, who wish to learn more about selecting a development with high potential using my 47 criteria to select an ideal unit to protect yourself from unfavorable situations.

or

If you have been living in your current home for some time and wish to assess your portfolio and explore possible next steps.

I welcome you to reach out to me by clicking the WhatsApp button below. Let's connect for a quick chat to discuss how I can possibly assist you. Speak soon.